Blockchains are changing the way you buy your home

#Blockchains #changing #buy #home [ad_1]

Blockchains are changing the way you buy your home – blockchain technology has already been successfully used for a number of years in Australia by a company called PEXA, which has recorded over 11million property transactions. The same firm has recently set its sights on the UK to revolutionise the way that mortgages are handled and processed. Digital currencies now offer those involved in buying or selling a property an increasing range of options to pay for real estate and avoid many of current costs – potentially much to the chagrin of existing lenders and intermediaries in the property sector.

Blockchains are changing the way you buy your home

Real estate transactions have barely changed. Ordinarily, the buying and selling of real estate is recorded on a central register known as the Land Registry, but the World Bank estimates that “70 per cent of the world’s population still lacks access to proper land titling…” and even in so-called sophisticated jurisdictions such as the UK, 15% of property is not recorded on the Land Registry. For example, if someone has owned a property before 1990 and not taken out a mortgage since, the property may not be registered. However, the way that people buy and sell their homes is slowly changing thanks, in part, to the gradual introduction of technology. Traditional banks, lenders, lawyers, escrow agents, etc, are increasingly facing a choice as to how money is transferred from both lender to borrower and from the buyer to the seller of a property. The use of digital assets means that it is now cheaper to transfer money between different parties, and the amount of money to be saved using a digital currency pegged to the $ or € or £ etc could be quite considerable.

The first digital £ (GBPT) was launched in July 2022 by a firm called Blackfridge (based in the Isle of Man), with KPMG carrying out a monthly attestations to confirm that all GBPTs are indeed 100% backed by the equivalent amount of cash. GBPT’s differ from most UK banks where depositors’ money held is used for other lending activities, i.e., if the banks’ customers ask for their deposits back on the same day it is highly unlikely the bank could do so. In the last year in the UK there were approximately 1 million property transactions where, typically, financial institutions confirm what they owe each other and transfer monies using the interbank messaging service SWIFT (which charges a fee of £25). Very few real estate transactions involve transferring money directly from buyer to seller as the monies customarily go via the buyers’ and sellers’ respective lawyers. It would not be untypical for buyers to transfer monies to their lawyer’s clients’ account when the lawyers have agreed the transaction, after which the buyer’s lawyers transfers money to the seller’s lawyers. Once the seller’s lawyers have deducted their fees the residual capital is transferred to the seller. i.e., at least three transactions/messages are generated: £25*3= £75 for the sale of one home in SWIFT messaging fees alone. This equates to £75million p.a. just for UK mortgages.

Over in the US, the cost to deposit and receive money (wire transfer fees) is typically $15 to receive and $25 to send. Given that last year there were 6million property transactions, the cost to move money from the buyer to seller equates to approximately $240million. A large proportion of these real estate money transfer fees in the US and in the UK could actually be eradicated using a CBDC or a stablecoin – i.e., a digital currency pegged to a fiat currency. Such digital currencies commonly use blockchain technology and, according to CoinGecko, there are 90 stablecoins with a market value of $140billion in existence.

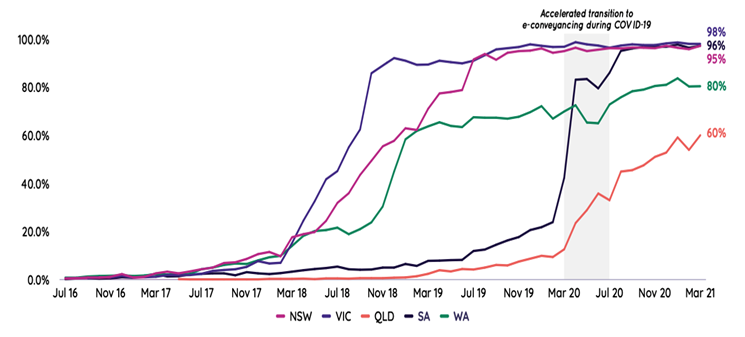

However, it is not only digital currencies that are set to impact the way homes are bought and sold. In Australia, Property Exchange Australia, (PEXA) provides a centralised platform giving lenders, buyers’ and sellers’ lawyers and the Land Registries the ability to communicate; that is, having one ledger to enable a more efficient and faster way to transfer real estate titles. Listed on the Australian Stock Exchange, PEXA was established in 2013 and has created an e-conveyancing solution for the Antipodean continent. In 2011, the Australians introduced legislation called the Electronic Conveyancing National Law Agreement enabling registered “subscribers” (lawyers, conveyancers and lenders) to use the system on behalf of buyers and sellers of real estate. The registered subscriber has authorisation to both digitally sign any registry instruments and authorise financial settlements on behalf of a client, so avoiding delays in requesting additional authorisation and signatures. Using blockchain technology, one secure data base that relevant parties can have access to has, in effect, been created and it has been so successful that, according to Legal Futures, “80% of conveyancing completions in Australia” are now run via the PEXA platform. The property exchange has, itself, handled over 11million real estate transactions in Australia to date, reporting that “in Australia, re-mortgaging times have dropped from an average of 42 to 15 days, with some re-mortgages even completing in one day.”. This is a good example of how blockchain technology has been used to transform the buying and selling of homes in Australia by improving the speed of property transactions. Now PEXA is turning its attention to England and Wales to potentially transform property transactions, having already completed its first re-mortgage in the UK. Additionally, other firms using blockchain technology in Australia include Bricklet and Smypli.

The % of transfers lodged on PEXA for five of Australia’s states

However, it is not only in Australia that blockchain-powered platforms are being used in the mortgage market, but in the US too. In March 2022, Figure Lending LLC and Apollo completed a transaction involving the origination of digital mortgage loans and transfer of ownership over a blockchain – the secure, streamlined process being a ‘first-of-its-kind’ in the mortgage industry. A process such as this offers the potential to revolutionise the $13trillion US mortgage market which last year saw over $2trillion of mortgages being created. Figure Lending’s GM, Daniel Wallace, has reported: “Blockchain can provide enhanced protections and transparency in the ownership process for consumers and real-time settlement for investors, replacing trust with truth to create a faster, more efficient process for everyone. This important development demonstrates just one way that blockchains will provide significant improvements that streamline the mortgage lending space.”

So, reducing the time and cost to buy and sell a property not only benefits homeowners but also helps to make real estate (an inherently illiquid asset class) a little more liquid for all. Interestingly, if you look at PEXA’s website, whilst the company uses blockchain technology it does not make a ‘song and dance’ about Blockchain itself. Then again, why should it? Having used the tech for years, it works for PEXA and the 11million transactions it has completed to date. Does this then mean we could see more firms which use blockchains talk less about the technology and more about the advantages and benefits? After all, how many firms wax lyrical about the fact they “have a website”, or their “dot com on-line expertise” which were very much the fashion 20 years ago…….?

[ad_2]

Source link